In such a time, politicians, bankers, investors, and ordinary home buyers mutually bolster the real estate market. GDP, it is not surprising that a wide range of society tries to take advantage when house prices are going up. As the housing sector takes a considerable slice from the U.S. Owning a house has traditionally been a part of the American dream. What is the bottom line? Even if the rental prices are not affected, external circumstances in the economy can influence the property's market value through the capitalization rate. Let's assume the opposite situation: what happens when interest rates go down? In that case, the cap rates drop as well thus, your house price rises. Why? Because investors must pay less for your home to receive a higher rate of return after the same net income. It follows that investors are not satisfied with a 10 percent rate of return anymore, but they require, let's say, a 12 percent cap rate for real estate investment.Īs you can see, at the time of increasing interest rates, your house became less valuable. In such a case, other types of investments that are more directly connected to interest rates (for example, corporate bonds) may become more attractive for investors than buying properties.

In this vein, let's consider a situation of hiking interest rates. One of the common external aspects that can alter the business environment is a change in interest rates. That means that your house is worth $120,000. Value of the property = Annual net income / Cap rate

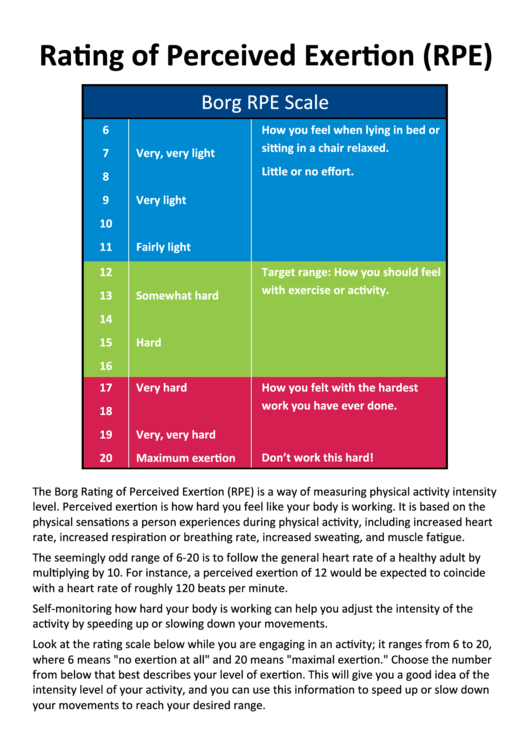

RATE IT 7 OUT OF 5 HOW TO

You probably already know how to get this number, but to see this with a mathematical expression, we need to rearrange the previous formula: This is expressed in the context of property investment:Ĭap rate = Annual net income / Value of the propertyīut what is the value of the investment if you have, let's say, $12,000 yearly net income on your property after receiving $1,000 monthly rents (or you find out that you could have such net income if you were to rent out your house)? Rate of return = $100 profit / $1,000 investment = 10% So, for instance, if you invest 1,000 dollars, you make 100 dollars which is a 10 percent return on investment. The 10 percent cap rate means a 10 percent profit on an investment. Let's say you are considering selling your house, and after some research, you see that investors are buying properties like yours at a 10 percent capitalization rate. Probably the best way to understand how applying the capitalization rate helps in property evaluation is to look at a real-world example. Lastly, divide the net income by the property value to obtain the cap rate: Use the following formula above to calculate the net rental income: Let's say you have to spend $500 monthly on costs – this is $6000 a year, which is equal to 20% of your gross income (you can set the value of operating expenses in the advanced mode). Let's say that the property stays unoccupied for 2% of the time.ĭecide on the percentage of operating expenses. Let's say it is equal to $30,000 per year.ĭetermine the vacancy rate. It is simply the amount of money you get from your tenants each year.

Let's say it is equal to $200,000.įind out your gross rental income. To do it, follow these simple steps:īegin with determining the property value – it can be, for example, its selling price. You can use the formulas mentioned above manually or calculate the cap rate with our cap rate calculator.

/GettyImages-180734345-ec5247651d704f57a7117eee952be492.jpg)

Net income = (100 - operating expenses) * (100 - vacancy rate) * gross income You can then use the following formula for the net income: It is important to note that operating expenses do not include mortgage payments, depreciation, or income taxes therefore, the net income is the cash you earn before debt service and before income tax. In that case, you can also include additional parameters: the vacancy rate (that is, during what percentage of the time does the property stay unoccupied) and the percentage of operating expenses (such costs as insurance, utilities, and maintenance). Suppose you are a more advanced real estate investor. (For more information on ratios, check our ratios calculator). In other words, this ratio is a straightforward way to measure the relationship between the return generated by the property and its price. Basically, the cap rate is the ratio of net operating income (NOI) to property value or sales price.Ĭap rate = net operating income / property value The description above makes it easy to figure out the cap rate formula by yourself.

0 kommentar(er)

0 kommentar(er)